Post Covid Digital Engagement Across Collections & Recoveries

The Covid pandemic has undoubtedly accelerated the adoption of digital strategies and processes for creditors, C&R service & technology suppliers and for their customers (debtors).

This is as true for late-stage recoveries (litigation and enforcement) as it is for collections. The requirement to have real-time updates (typically enabled by API) on recoveries activity (for example an enforcement officer making contact with a consumer on the doorstep and the resulting outcome) is becoming the norm rather than a “nice to have”. Just’s innovation of Virtual Enforcement (VE) is an example of how digital can improve customer treatment as well as bring forward account resolution & cash collection.

Just’s sister company Arum has just completed the most comprehensive digital survey of Collections & Recoveries managers responsible for the whole arrears lifecycle. Responders were from the UK, Europe and beyond and covered all major industry verticals including utilities (including responses from both top 3 water and energy organisations), banks & other financial services through to debit purchasers.

What the survey show is that all organisations have digital transformation ambitions and Covid has meant this needs to be delivered quicker and deeper. The challenge often is legacy systems and processes were not always built for the digital world.

The summary of the report below we hope gives a flavour of where digital transformation really is in the UK C&R market.

Digital can transform your collections function

There is a lot of hype within collections regarding digital transformation, so Arum spoke to industry leaders across financial services, utilities, and government, in the UK, mainland Europe and South Africa, to find out how it’s being used and what benefits people are seeing.

What’s the main takeaway?

Many organisations are already focused on achieving digital automation to improve the customer experience but there is an acceptance post-COVID that digital must accelerate. Collections teams may want to review possibilities of more functions, better accessibility on a greater number of channels, and improved APIs from core systems. A stronger focus on the customer journey and what collections customers need to do is in most cases pivotal, whilst designing business processes, typically around legacy systems.

Key findings

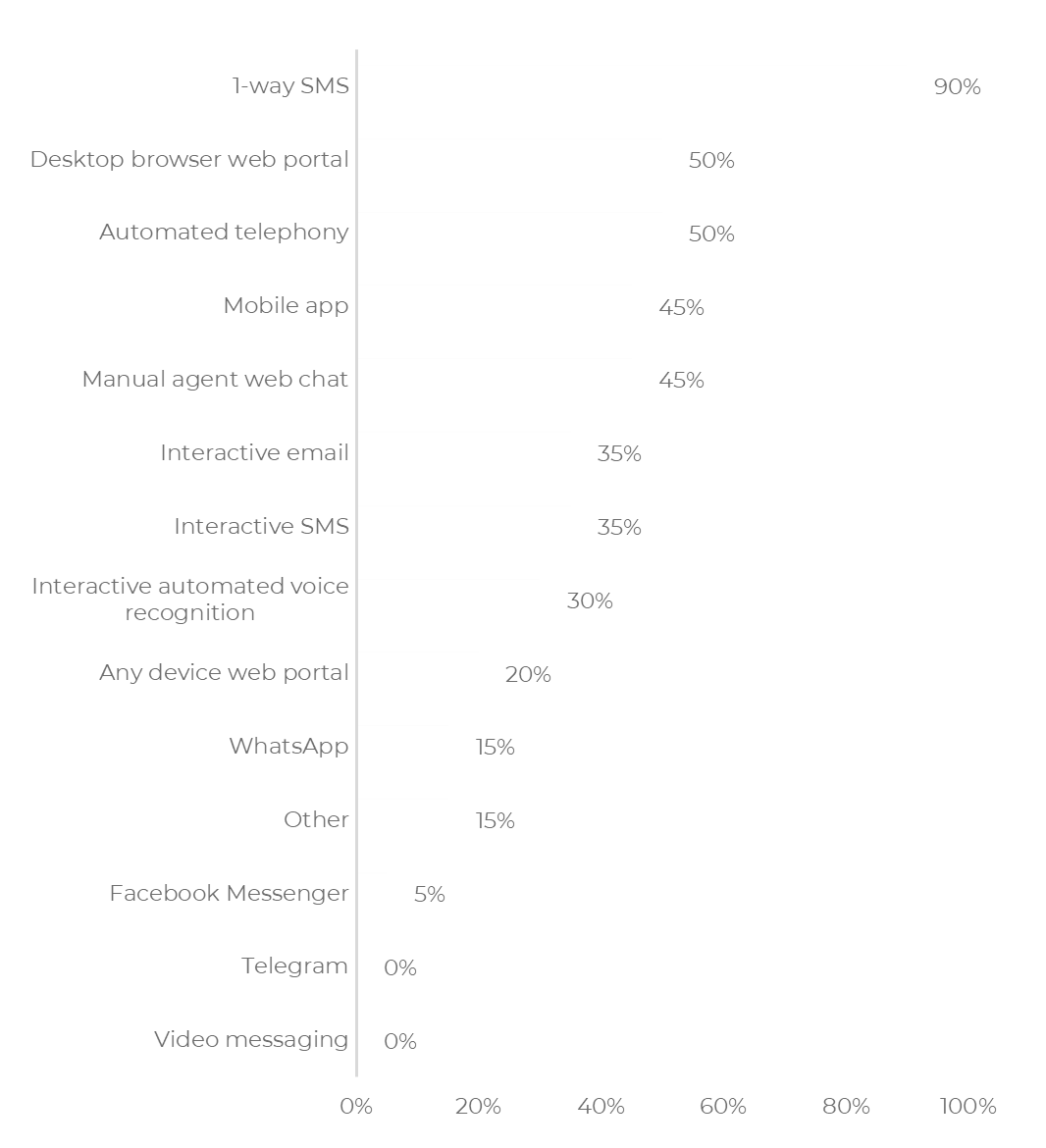

What digital channels are being used?

- 90% of organisations use 1-way SMS

- 75% offer 1-way no-reply emails

- 45% offer a collections portal

- 15% use WhatsApp

- 5% use Facebook Messenger

Arum expects a significant increase in WhatsApp usage as messaging as a UI continues to gather pace.

How many channels are being offered?

- 8 is the highest number of digital channels

- 2 is the lowest number of channels

There is a correlation between an increased number of digital channels and higher levels of self-service

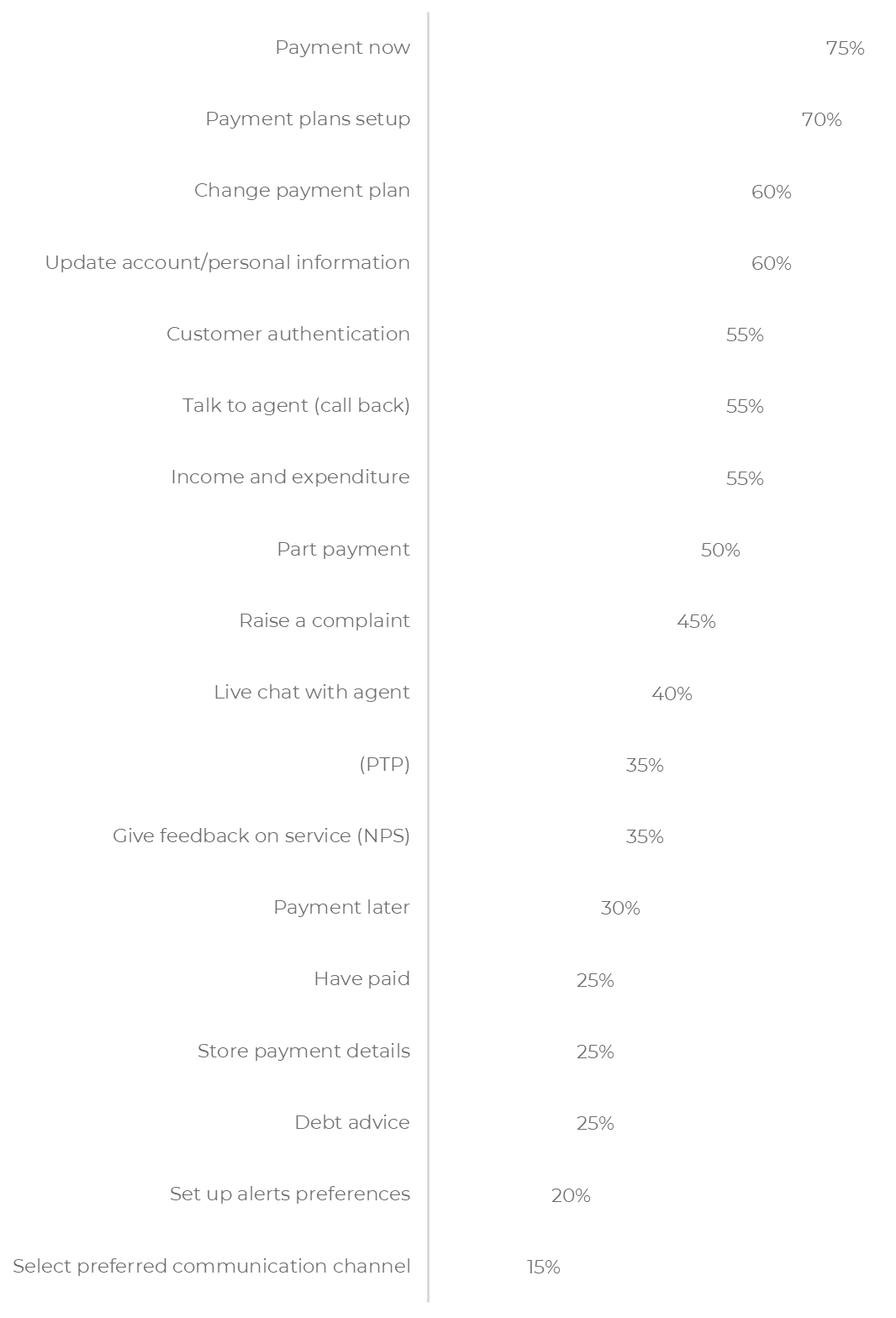

What can customers do on digital channels?

- 70% offer digital forbearance

- 65% offer digital I&E

- 40% offer live chat with agent

- 35% offer digital promises to pay

- 15% enable Offer customer communication preferences

- 6% offer digital I&E integrated with open banking

If customers don’t have their expectations met when accessing digital channels, it can be frustrating.

How many organisations are using chatbots?

- 35% use chatbots

- 15% of chatbots offer a personalised arrears service

There is a lot of hype, but collections chatbots are only doing the basics!

Omnichannel or multichannel?

50% of the market uses omnichannel digital communications.

Collectors can increase customer engagement rates by 2x with omnichannel over multichannel.

Self-service rates

Arum knows organisations can hit up to 90% self-service, how close are you?

- 45% have less than 25% self-service

- 50% have 25-50% self-service

- 5% have 75-90% self-service

When organisations were asked to select all the digital engagement channels they offer customers in collections, they responded with:

What can customers do on digital channels:

Arum’s full 32-page report covers all of this and more details around: Digital business case drivers, digital strategy, customer engagement channels, design principles, customer journeys for payments, integration, challenges to digital progress, and reflections on past projects.

You can find out more about the report here: arum.co.uk/digital-collections-evolution-survey

Russell Robinson

Head of Digital

Arum

Russell focuses on improving customer experience through digital transformation. Having co-founded Telrock in 2001, Russell went on to lead the company as CEO before the company was acquired. Russell then joined industry giant FICO as managing director of FICO Customer Communications Services for the EMEA region before joining Arum in his current role.